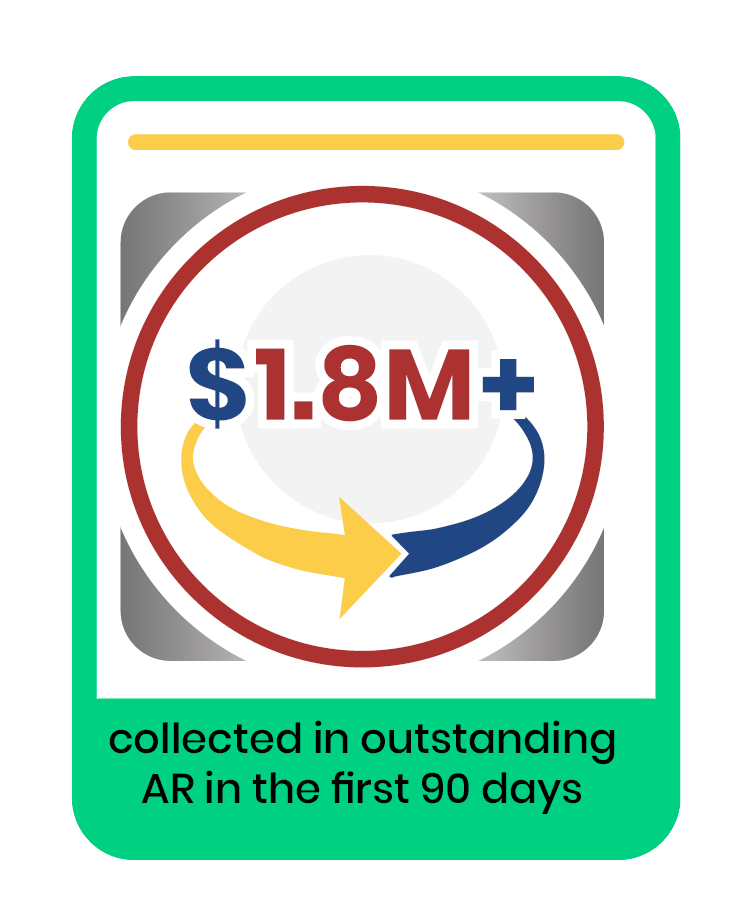

Collecting More Than $1.8M in Outstanding Invoices in 90 Days and Increasing Cash Flow by 7+ Figures Annually

The Company

The Field Service company,

a Commercial Food Equipment Service Association (CFESA) member, is one of the largest service providers serving the American Southeast with offices located in Alabama,

Tennessee, Georgia, Florida, Mississippi

and Louisiana.

The full-service parts and repair company prides itself on the high quality of repair and maintenance they provide for restaurants, convenience stores, and other commercial kitchens, thanks to a team of highly skilled technicians and support personnel.

Due to their rapid growth and success, the company has recently joined a private equity-backed company to maximize growth efforts and offer wider coverage.

Collecting More Than $1.8M in Outstanding Invoices in 90 Days and Increasing Cash Flow by 7+ Figures Annually

The Company

The Field Service company, a Commercial Food Equipment Service Association (CFESA) member, is one of the largest service providers serving the American Southeast with offices located in Alabama,

Tennessee, Georgia, Florida, Mississippi and Louisiana.

The full-service parts and repair company prides itself on the high quality of repair and maintenance they provide for restaurants, convenience stores, and other commercial kitchens, thanks to a team of highly skilled technicians and support personnel.

Due to their rapid growth and success, the company has recently joined a private equity-backed company to maximize growth efforts and offer wider coverage.

The Challenge

As the field service industry slowly inched back to pre-COVID activity,

the company saw a massive pickup in business. But with just one person doing collections, total past due receivables ballooned to

over $3.24M.

The Field Service company lacked a concrete collections process, further hurting the company’s cash flow as past due AR grew with every unsent collection email. Christine, the one-person collections department, was also overburdened by the

volume of collection tasks she had to complete in a day.

The Solution

The food equipment service provider partnered with Origo to build an offshore collections team in

the Philippines.

In just two weeks, Origo hired, trained, and deployed a team to support the company’s collection efforts and free up Christine’s day, allowing her to focus on higher priority tasks. The offshore team also created a collections playbook to run delinquent accounts in an efficient collection system that sends timely email follow-ups

and outbound calls.

The Company

The Field Service company,

a Commercial Food Equipment Service Association (CFESA) member, is one of the largest service providers serving the American Southeast with offices located in Alabama,

Tennessee, Georgia, Florida,

Mississippi and Louisiana.

The full-service parts and repair company prides itself on the high quality of repair and maintenance they provide for restaurants, convenience stores, and other commercial kitchens, thanks to a team of highly skilled technicians and support personnel.

Due to their rapid growth and success, the company has recently joined a private equity-backed company to maximize growth efforts and offer wider coverage.

The Challenge

As the field service industry slowly inched back to pre-COVID activity, the company saw a massive pickup in business. But with just one person doing collections, total past due receivables ballooned to over $3.24M.

The Field Service company lacked a concrete collections process, further hurting the company’s cash flow as past due AR grew with every unsent collection email. Christine, the one-person collections department, was also overburdened by the volume of collection tasks she had to complete in a day.

The Solution

The food equipment service provider partnered with Origo to build an offshore collections team in

the Philippines.

In just two weeks, Origo

hired, trained, and deployed a team to support the company’s collection efforts and free up Christine’s day, allowing her to focus on higher priority tasks. The offshore team also created a collections playbook to run delinquent accounts in an efficient collection system that sends timely email follow-ups and outbound calls.

The Company

The Field Service company, a Commercial Food Equipment Service Association (CFESA) member, is one of the largest service providers serving the American Southeast with offices located in Alabama,

Tennessee, Georgia, Florida, Mississippi and Louisiana.

The full-service parts and repair company prides itself on the high

quality of repair and maintenance they provide for restaurants, convenience stores, and other commercial kitchens, thanks to a

team of highly skilled technicians and support personnel.

Due to their rapid growth and success, the company has recently

joined a private

equity-backed company to maximize growth efforts and offer wider coverage.

The Challenge

As the field service industry slowly inched back to pre-COVID activity, the company saw a massive pickup in business. But with just one person doing collections, total past due receivables ballooned to over $3.24M.

The Field Service company lacked a concrete collections process,

further hurting the company’s cash flow as past due AR

grew with every unsent collection email. Christine, the one-person collections department, was also overburdened by the volume of collection tasks she had to complete in a day.

The Solution

The food equipment service provider partnered with Origo to build an offshore collections team in the Philippines.

In just two weeks, Origo hired, trained, and deployed a team to support the company’s collection efforts and free up Christine’s day, allowing her to focus on higher priority tasks.

The offshore team also created a collections playbook to run delinquent accounts in an efficient collection system that sends timely email follow-ups and outbound calls.

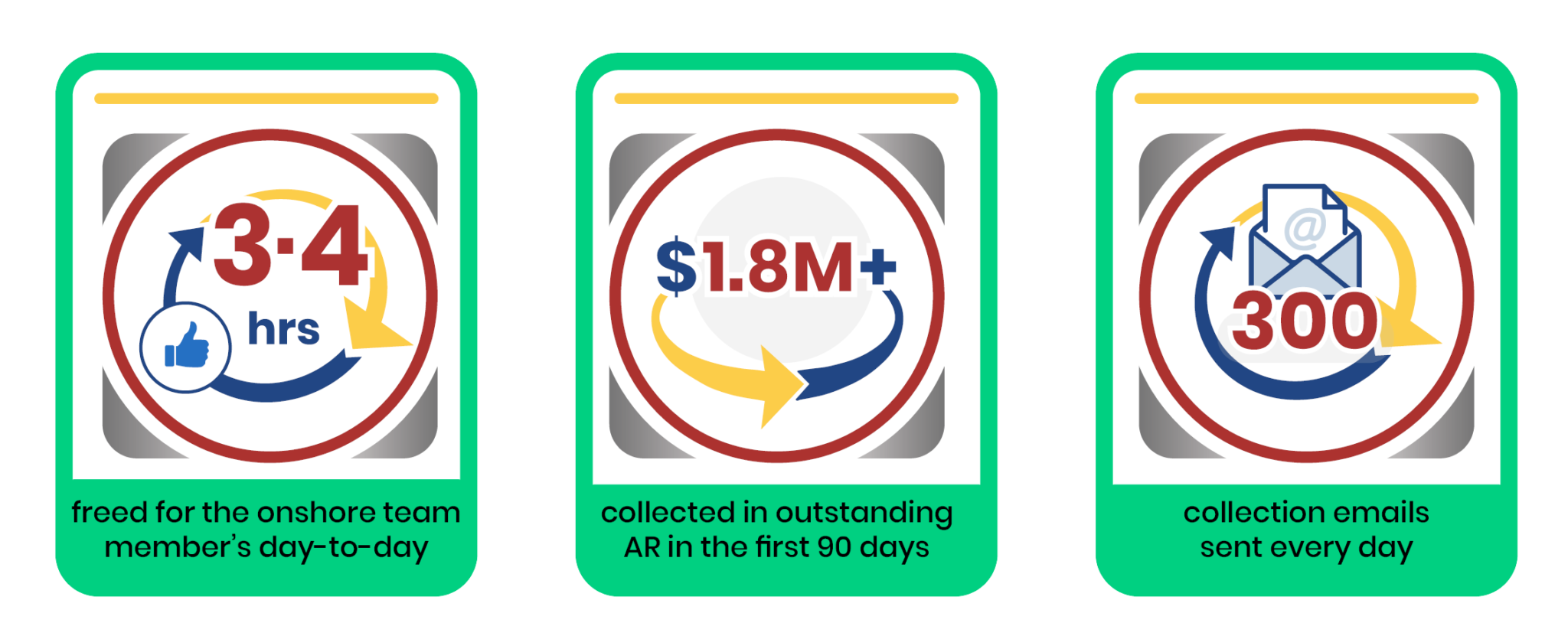

The Result

- Christine is now focusing on inbound calls and disputes instead of doing collections by herself, freeing up 3-4 hours in her day

- Collections and follow-ups are now done proactively, recovering as much as seven figures or even more in annual cash flow.

- Thanks to a more efficient collections playbook, the offshore team is now able to send 300 email follow-ups a day.